Client focus: educating our clients

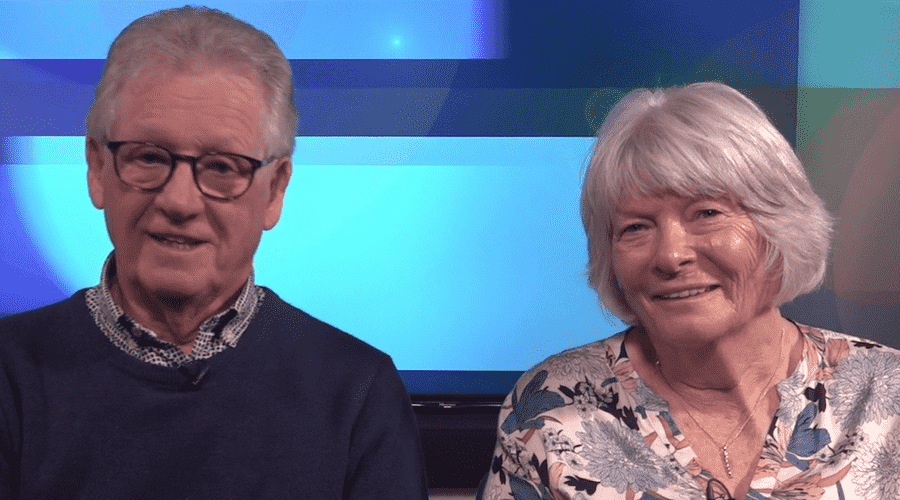

Dying Matters Week is an opportunity to promote open and honest conversations about end-of-life matters with loved ones. Sometimes when it comes to family, the most important conversations are often the ones had least, such as what will happen when you’re no longer here. This is a situation that AFH adviser Mark Sidaway experienced when the husband of one of his clients passed away.